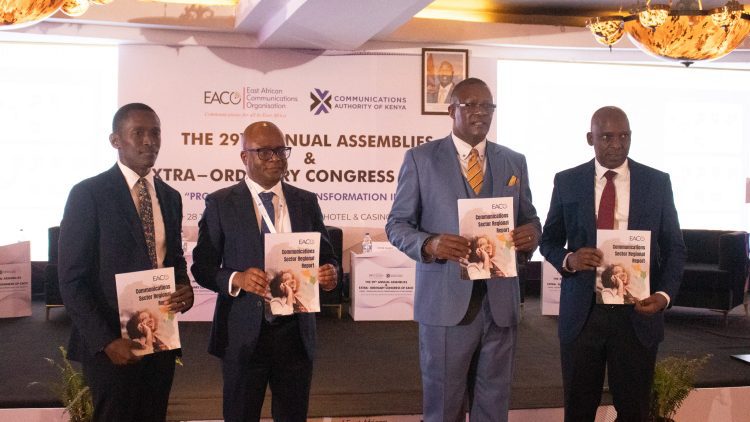

The 2023 EACO Communications Sector Regional Report was launched on 24 June 2024 during the 29th Annual Assemblies and Extra Ordinary Congress of EACO in Nairobi, Kenya. This 17-page report consolidates data analysed by the East Africa Communications Organisation (EACO) secretariat using inputs from the EACO databank. The indicators align with those reported in the ITU, ensuring consistency and reliability.

In the report foreword, Dr Ally Simba, Executive Secretary of EACO, explains, “Our region has witnessed remarkable advancements in network coverage, a surge in mobile and internet subscriptions, and notable growth in mobile money services. These developments have driven socio-economic growth, fostered digital inclusion, and enhanced connectivity across East Africa.”

Here are some highlights from the report:

EAC Telecom Statistics 2023

- Mobile Telephony: 100% penetration with 199.7 million subscribers.

- Internet Subscriptions: The EAC region has 122.3 million subscriptions.

- Mobile Money: The volume of mobile money subscriptions is estimated at 128.7 million subscribers.

Network Coverage

- 2G Coverage: 2G coverage has remained stable across the region, with a regional average of 92%. Countries like Burundi, Rwanda, and Uganda maintain high coverage, ensuring basic communication services are widely accessible. Notably, Tanzania showed significant progress, increasing from 94% to 98%, attributed to continued infrastructure investments and rural coverage initiatives.

- 3G Coverage: The regional average increased from 71% to 78%. Kenya and Rwanda lead with almost universal 3G coverage, maintaining rates of 97% and 99%, respectively.

- 4G Coverage: There has been a significant increase in 4G coverage across the EAC member states. The average population coverage has risen from 52% to 62%, with Rwanda and Kenya leading the way with close to or exceeding 97% 4G coverage in 2023.

Telephone Subscriptions and Mobile Data Tariffs

The mobile industry in East Africa is experiencing significant growth, with the average mobile penetration rate across the region reaching 100% in 2023. This growth outpaces both the average of the ITU Africa region (92% in 2023, up from 82% in 2021) and the global average (111% in 2023, up from 107% in 2021).

East Africa is one of the fastest-growing mobile markets in the world, and this growth is expected to continue in the coming years. This presents a significant opportunity for mobile operators, handset manufacturers, and other players in the mobile ecosystem.

The influx of low-cost smartphones from Chinese manufacturers has made mobile phones more accessible to a wider population. Increased competition among mobile network operators and government interventions have also driven down data costs, making internet access more affordable.

Services like M-PESA in Kenya have created a financial ecosystem reliant on mobile phones. The average mobile internet penetration in the East African Community region increased from 49% in 2022 to 51% in 2023.

Mobile data prices have fallen significantly across East Africa between 2020 and 2023. The falling price of mobile data, combined with the proliferation of smartphones and tablets, suggests that mobile data is becoming the primary way people access the internet in East Africa.

Domestic Voice Traffic

The domestic voice traffic segment in the ICT sector across the East African market has exhibited diverse performance trends from 2022 to 2023.

- Kenya: Recorded a 13% growth in domestic voice traffic, rising from 78.13 billion minutes in 2022 to 88.65 billion minutes in 2023.

- Rwanda: Experienced a robust 20% growth in domestic voice traffic, climbing from 28.6 billion minutes in 2022 to 34.23 billion minutes in 2023.

- South Sudan: Saw a significant 31% increase in domestic voice traffic, from 4.12 billion minutes in 2022 to 5.53 billion minutes in 2023.

- Uganda: Voice traffic grew 7%, from 66.71 billion minutes in 2022 to 71.56 billion in 2023.

Key advancements in the EAC

The 2023 report highlights the significant progress in the telecommunications sector across the East African region. Key advancements in network coverage, mobile and internet subscriptions, and mobile money services have driven socio-economic growth, fostered digital inclusion, and enhanced connectivity. The East African mobile market continues to expand rapidly, presenting numerous opportunities for stakeholders. The falling data costs and increasing smartphone accessibility underscore the region's shift towards mobile data as the primary means of internet access. This growth trajectory is expected to persist, further solidifying East Africa's position as a dynamic and fast-growing telecommunications market.